Banking cyber security protects £8.5 trillion in UK financial assets from sophisticated cyber attacks. Financial institutions face 300+ cyberattacks daily, with USB borne and AI malware threats representing 23% of successful breaches, making comprehensive removable media security essential for regulatory compliance and customer protection.

Protecting the Heart of the Economy

Financial institutions operate in the most targeted cybersecurity environment globally. Banks, investment firms, and insurance companies manage sensitive customer data, facilitate trillions in transactions, and maintain critical payment infrastructure that cybercriminals relentlessly attack for financial gain.

Unique Financial Sector Challenges

Regulatory Complexity

Financial services face stringent cybersecurity requirements under PCI DSS, FCA regulations, PRA supervisory statements, and GDPR. Compliance demands comprehensive security measures with detailed audit trails and incident reporting capabilities.

High-Value Target Profile

Financial data commands premium prices in criminal markets. Customer personal information, payment card details, and trading algorithms represent attractive targets for both cybercriminals and nation-state actors seeking economic intelligence.

Operational Continuity Requirements

Trading systems, payment networks, and customer services cannot tolerate extended downtime. Security measures must provide robust protection whilst maintaining the millisecond response times that modern financial markets demand.

Financial Cybersecurity Threat Intelligence

The Bank of England’s Financial Policy Committee reports alarming trends in financial cybersecurity:

- £1.3 billion losses from cybercrime in UK financial services (2024)

- 847% increase in ransomware attacks against financial institutions since 2022

- Average £4.2 million cost per data breach in the financial sector

- 89% of financial cyber incidents involve insider threats or external media

Assess Your Financial Institution’s Cyber Risk – Get a confidential vulnerability assessment from our banking security specialists.

Banking Cybersecurity Threats

USB and Removable Media Threats

Trading floors, branch offices, and data centres regularly receive external media from auditors, vendors, and regulatory authorities. These USB devices can contain sophisticated malware designed to steal customer data or manipulate financial systems.

Supply Chain Vulnerabilities

Financial institutions rely on numerous third-party providers for software, hardware, and services. Compromised suppliers can introduce malware through legitimate business channels, including infected USB devices containing software updates or configuration files. Read more on why industrial cyber security matters

Insider Threat Scenarios

Employees with privileged access can use USB devices to exfiltrate customer data, trading information, or proprietary algorithms. These insider attacks often go undetected for extended periods, maximising potential damage.

Financial Services Success Story

A major UK investment bank prevented a potential £78 million data breach by implementing comprehensive USB security controls. Their hardware-based scanning approach detected advanced malware on an auditor’s USB device before it could access customer trading data, demonstrating the critical importance of removable media security in financial environments.

The Unmatched Power of TYREX: Measurable Success

Cyber Security for Banks: Advanced Threat Protection

Advanced Persistent Threat (APT) Defense

Financial institutions face sophisticated, long-term attacks designed to steal valuable information or manipulate financial systems. Multi-layered security approaches provide defense-in-depth against these advanced threats.

Zero-Day Exploit Protection

Hardware-based security solutions can detect and block unknown threats that signature-based systems miss, providing crucial protection against zero-day exploits targeting financial systems.

Incident Response and Recovery

Specialised incident response procedures for financial services that balance security requirements with regulatory reporting obligations and customer communication needs.

Regulatory Compliance for Financial Institutions

Financial Conduct Authority (FCA) Requirements

The FCA expects firms to maintain robust operational resilience including comprehensive cybersecurity measures. USB security controls demonstrate appropriate risk management for customer data protection.

Prudential Regulation Authority (PRA) Supervisory Statements

Major banks must implement comprehensive cybersecurity frameworks under PRA SS2/21. This includes specific requirements for managing removable media risks that could impact financial stability.

Payment Card Industry Data Security Standard (PCI DSS)

Organisations processing card payments must implement comprehensive security measures including controls for removable media that could access cardholder data environments.

K-REX Console

The CONSOLE can be placed on a desk, which makes it convenient for any standard work environment. This USB media decontamination solution protects your critical infrastructures from cyber threats.

Features

- Available in 4G, 5G, WiFi, wired and offline

- 10 inch HD screen

- Weight: 12kg

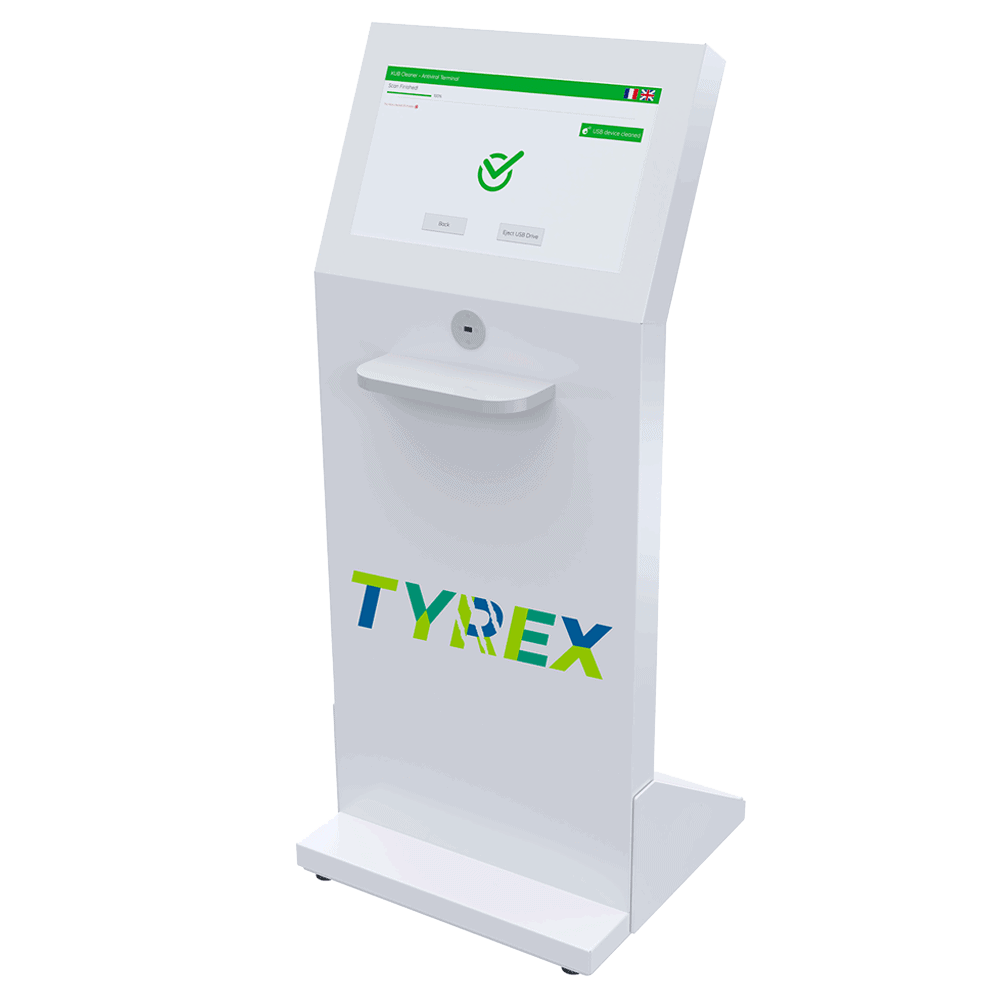

K-REX Totem

The TOTEM can be positionned on the floor, at the entrance of reception halls or in any public areas. This USB decontamination solution comprises a small platform to hold your hard drive during the antivirus scan.

Features

- Available in 4G, 5G, WiFi, wired and offline

- 24 inch HD screen

- Weight: 54kg

K-REX Satallite

The SATELLITE USB decontamination station can be hung on a wall. It is particularly adapted to confined spaces such as ships or meeting rooms. With 5 anti-virus and 2 anti-malware running simultaneously, the SATELLITE is able to scan and clean your USB devices and prevent cyber threats or viruses from spreading through your information system.

Features

- Available in 4G, 5G, WiFi, wired and offline

- 7 inch HD screen

- Weight: 6kg

K-REX Mobile

The MOBILE is a movable USB decontamination station. Ruggedized with the MIL-STD-810G and ATEX military standards, it is designed for environments requiring mobility. With up to 5 antivirus and 2 optional anti-malware scanners running simultaneously, it is able to scan any USB or removable devices and prevent malwares or viruses from spreading through your information system.

Features

- Available in 4G, 5G, WiFi, wired, offline and ATEX versions

- 10 inch HD screen

- Weight: 1.3kg

Secure Your Agency’s Critical Data Today

Protecting the UK’s government and defence data from USB-borne threats requires a dedicated, robust, and physical solution. Software alone is no longer enough. Tyrex provides the military-grade hardware, specialised expertise, and certified assurance needed to secure your organisation’s most sensitive digital assets.

Comprehensive

Banking Cyber Security Solutions

Multi-Layered USB Protection:

Hardware-based USB decontamination stations provide tamper-resistant usb malware removal scanning for all removable media entering industrial networks. Multiple antivirus engines operating simultaneously detect both known and unknown threats before they reach critical systems.

Network Segmentation and Monitoring:

Proper network architecture isolates critical control systems from corporate networks whilst maintaining necessary data flows. Advanced monitoring solutions detect anomalous behaviour across industrial protocols.

Banking Cybersecurity Applications

Retail Banking

Customer-facing systems, ATM networks, and mobile banking applications require comprehensive security measures that protect personal financial information whilst maintaining user experience standards.

Investment Banking

Trading systems, market data feeds, and client communication networks need ultra-secure environments that prevent information leakage whilst supporting high-performance trading operations.

Insurance Services

Claims processing systems, actuarial databases, and customer communication channels require security measures that protect sensitive personal and financial information throughout policy lifecycles.

Customer Data Protection

- End-to-end encryption for all customer information

- Hardware security modules for cryptographic key management

- Comprehensive USB scanning for all external media handling customer data

Payment System Security

- Isolated networks for payment processing systems

- Multi-factor authentication for all privileged access

- Real-time monitoring for suspicious transaction patterns

Trading System Protection

- Ultra-low latency security controls for algorithmic trading systems

- Market data integrity monitoring and validation

- Secure communication channels for inter-bank transactions

Regulatory Compliance Management

- Comprehensive audit logging for all system access and data transfers

- Automated compliance reporting for regulatory authorities

- Incident response procedures specifically designed for financial regulations

Secure Your Financial Institution

Financial services cybersecurity requires specialised expertise and proven solutions designed for the unique challenges of banking, investment, and insurance operations. Protecting your institution demands comprehensive security measures that maintain regulatory compliance whilst supporting business operations.

With 300+ daily attacks targeting financial institutions and USB-borne threats responsible for 23% of successful breaches. Every day without comprehensive cybersecurity protection increases exposure to catastrophic data breaches and regulatory penalties.

Protect Your Financial Institution NowContact our banking cybersecurity specialists today for a confidential security assessment tailored to your financial services environment. Discover how military-grade USB protection has already prevented a £78 million data breach for a leading UK investment bank without impacting trading performance or customer experience.

TYREX Protection in Numbers

Latest From The Blog.

Cybersecurity and Resilience Bill: Safeguarding the UK’s Digital Future

Cybersecurity and Resilience Bill: Safeguarding the UK’s Digital Future

5 of the Worst Ransomware Attacks and How USB Hygiene Could Have Helped

5 of the Worst Ransomware Attacks and How USB Hygiene Could Have Helped

5 of the Worst Ransomware Attacks and How USB Hygiene Could Have Helped

What Apple’s Cyber Incidents Teach Us About Hardware Security

What Apple’s Cyber Incidents Teach Us About Hardware Security